Any advice for dealing with an international customer who is claiming they got charged import fees far greater than the value of the card and wants it refunded to them? Feels extremely scammy.

I upgraded them to the block list and haven’t yet responded.

Any customs issue is not your responsibility. If the importer feels they were charged too much they need to take it up with their customs agency.

Thanks for the response! I’ll leave it as is for now. I’m not too fond of paying people to take my cards ![]()

Did they say they were charged higher fees than the VAT plus customs fees or were they double charged (from customs and eBay)? If they were charged higher fees it’s possible that you declared an incorrect value or whoever reviewed the customs declaration messed up, probably not the case but could happen. If they were double charged they can just request eBay to refund them the VAT after the package arrives, so you could inform them of that, either way it’s most likely not your problem if you’re sure you did everything correctly.

I’m based in Canada. 99% of my customers are from the US. I charge $15 tracked shipping domestic, and $10 to the US (yes it’s cheaper for us to ship tracked to the US if you can believe it).

A customer from Austria purchased the card (value $39.99 CAD). Tracked shipping to Austria is $37.00, so, I yolo’d it (no tracking, customer had a decent amount of positive feedback).

The customer messaged me saying their customs department required a value of the item for it to be delivered and they proved them with the amount of $39.99 CAD and a screenshot of the sold listing.

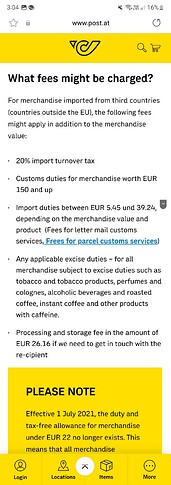

The customer then reached out stating that they needed to pay $39.87 Euros ($58.24 CAD) to their customs department to deliver the card. They sent a screen shot of this amount but It doesn’t show who it was paid too or what website it’s on.

Sounds like a handling / disbursement fee. That low value shouldn’t have import tax on it, but they are probably charging him for the time spent due to the package not having a value declaration on it? I know in the UK fedex will almost always charge me £15~ even if I do nothing wrong, just for the luxury of having them handle customs disbursement.

From my calculation they should have paid about 37,09€ if there was no customs declaration, so that could check out. 26,16€ of that would be the fees for the letter not having a customs declaration, if it indeed did not have one I could understand where the buyer comes from potentially wanting that part of the bill refunded by you.

They want the entire bill refunded. It would cost me about half as much to simply refund the card.

Sometimes when I order items internationally I have to pay extra fees to my customs department, I’ve never asked a seller to cover these fees.

Just trying to understand who exactly is responsible and what the proper course of action is.

Did you provide a value on the item when posting? On the outward customs declaration form? If so they shouldn’t have had to hold it before clearing.

Yeah wanting the entire bill refunded makes no sense since they would have had to pay everything apart from the handling fee anyway.

Seems like the 26 euro fee is whats inflated the price, unfortunately going back and forth with customs usually only ends one way regardless of who’s right

You do not have to pay anything. Customs is not your responsibility. If the buyer doesn’t like what happened, it’s a problem between them and their government.

Customs and import charges

As a buyer, it’s your responsibility to check which customs and import charges may apply, and to pay them. These import charges are generally based on the item’s price, weight, dimensions, and country of origin, as well as any taxes, duties, and fees added by your country.

Your seller might be able to give you some information about import charges, but before you bid on, or buy an item, it’s a good idea to check with your country’s customs office for more specific details.

Import charges include

- Sales, goods, and services

- Value added taxes

- Duties

- Tariffs

- Excise taxes

- Other amounts assessed or levied by any government authority in connection with the importation of goods into the applicable country of importation

- Third party brokerage fees (including advancement and disbursement charges as well as customs brokers’ handling and filing fees)

- Penalties

- Classification charges associated with the assignment of a Harmonized System (HS) classification code

- Charges for export compliance screening and verification and the assignment of an Export Control Classification Number (ECCN)

- Charges relating to the management of variances between the quoted import charges and actual costs

Import charges are in addition to the customs duties and taxes imposed by country tax and customs officials.

Do not ship untracked over the atlantic ocean. Bad things happen, I have not made any calculations, but I would reimburse the difference between the actualized and the normal import fee. The buyer could take it up with the customs departement, but that is not fair to the buyer

I payed about 500€ import duties last time I bought out side of EU, its just part of the deal for EU collectors and it shouldn’t be surprise.

Yep the beautiful handling fee even when you owe pennies which has happened to me before you get the handling fee whacked on.

Recently I’ve been getting handling fees for PSA subs that don’t even get actual tax charges. I just get a £12.50ish invoice from PSA a few weeks later lol

Be aware the buyer in Europe has to pay 20-25% taxes over the price of the card ++++ plus the shipping cost. On top of that customs fee they will charge a handling fee, which is most times around 15 Euro.

So a card of 30 Euro, with 10 Euro shipping, can be subject to a tax/import fee of around 25 euro.

Buyer is always responsible for those cost and should know their own laws regarding this.

Shipping untracked without value declaration might end up being more expensive than tracked with the value declaration.

This has been an interesting read learning how differently the different EU countries work. In finland it’s usually better to get untracked mail outside EU since those slip pass customs with no import fees. With ebay it doesn’t matter tho since it’s ebay that collects the import fees and forwards them to the customs. If an ebay order gets stopped by customs we can just mark that the import fees have already been paid for the order and they release it for free, not sure if that’s unique for finland.

Same in Norway, best is buying on ebay now, as they collect tax, and then we don’t have to pay transporter their fee.

The problem is when sellers don’t follow Ebay way of sending packages, and leave out the custom paid info, then it will cost a lot

Not always the case for sure, in Seychelles you are responsible for paying customs fee’s, in Australia however I believe ebay does handle it.