Hopefully my local businesses will use this opportunity to start producing vintage Japanese cards so I can finally buy them here.

…

That’s depressing.

It is so expensive to buy internationally from the UK. We are just a tiny island trapped XD the imports, taxes, VAT buying outside the UK is ridiculous. This is especially frustrating for pokemon cards as the majority seem to be in the US and Japan ![]() There are many instances where I have to pass on cards etc I want because of the Fees, postage, VAT, imports and handling fees.

There are many instances where I have to pass on cards etc I want because of the Fees, postage, VAT, imports and handling fees.

It is like the government don’t want to trade abroad or make it viable. We will become a reclusive country :'D

No more 3€ psa purchases from the US, damn.

Oh hell no, so the rumours about this change all around EU were true. It’s only 5 days since Finnish customs made update on their webpage, we already had some discussion about it.

tulli.fi/en/-/all-web-store-purchases-delivered-from-outside-the-eu-must-be-cleared-through-customs-as-of-july

www.elitefourum.com/t/hooray-more-import-taxes-to-pay/31941/1

It will be brave new world out there after July, use remaining time before it very well. ![]()

But if for example a friend sends me a package from outside the EU does it count as a gift or as consumption of goods? I don’t know what they mean by cosnumption of goods. Also, there was some sort of law for receiving packages from someone that isn’t a seller from oustide the EU, no?

Edit: this is limited to business/sellers, right? Does it include like a family member sending goods to another family member?

Really?! Ffs… lately I already had to pay more and more import fees due to a lot of cheaper shipping services being unavailable in Asia, so I had to ship with DHL/EMS/FedEx/etc. I paid 105 euros (~126 USD) yesterday to pick up a package; 27 euros the day before; 53 euros last week… And with some of those packages I was kinda expecting it, since I knew they were shipped with EMS shipping option, for which I as long as I can remember had to pay fees on arrival when it was above 22 euros (except for the one of 53 euros, since it came from the UK… dang Brexit ![]() ).

).

But if even those 5 euro packages from anywhere outside of Europe are starting to cost import fees it would really suck. Those < 22 euro rule at least makes it somewhat bearable… And before this pandemic most of the shipping options didn’t cost any import fees on arrival fortunately enough (unlike rn). How much are they going to charge anyway? Does this mean that I have to pay 50 cent import fees for 3 euro packages for example? Or is the 22 euro threshold simply lowered. Considering I have to pick up every package I have to pay import fees on manually at the post office, it not only costs more money, but more time as well… As muk said: that’s depressing… ![]()

Greetz,

Quuador

The way I understand it, if you buy on eBay, that’s an “elecronic interface” between you and the seller and thus they’re responsible for paying the VAT, so eBay for one must include that charge in your item price already. Now, how that would work for a middleman company is beyond me, as the parties involved are the seller, yahoo/mercari etc, the company and then you. Am I responsible for declaring VAT if my middleman doesn’t? How do customs know when the package arrives?

Oh boi, might this be another rule that has been written w/o taking all aspects of a realistic implementation into account like the whole Article 13/17 debate?

Just to be clear, because I didn’t find anything about it… does this also include gifts? Just in case some Japanese guys want to send me some gifts…

@burnedos we’ve had this in the UK since January. Since then I haven’t bought anything from overseas without the GSP (this works the same as it did before), but whenever I’ve gone to checkout something without the GSP I’ve been prompted to pay an additional 20% VAT charge on the total price (I‘ve never completed the purchase after this point, but I would assume I would not be charged again).

Using a middleman seems to be the same as before, i.e. you don’t pay VAT at the point of sale, but when the package is shipped to you. You receive an invoice from the delivery company after HMRC/the customs office raises the charges based on the declared value.

So I have two questions regarding this.

In the Netherlands we have to pay administration costs to our postal company because they have to make the customs declaration, we cannot do this ourselves. This is a flat rate of 13 euros for standard packages and 17,50 for EMS packages, does this mean we have to pay 13 euros extra on top of the taxes? That would be stupid on 1 or 2 dollar cards.

If you buy on ebay from outside the EU or the UK you pay 20% VAT on checkout, how do customs know you already paid these charges and you do not have to pay double once it arrives? I would imagine stores will get stickers or something to show that custom charges are already paid, but I cant imagine small ebay sellers will also get this.

Does anybody know how these two things are going to pan out?

For us in the UK this was a really good thing and I’m sure it’ll be similar for EU member states. Whenever I had an import tax charge come through in the past it always included a nice little “admin fee” of anywhere between £8 and £16. This meant if I previously purchased a £15.01 item I’d not only have to pay an additional £3 in import tax but also £8 to £16 on top of that as an admin fee, meaning my £15 purchase ended up sometimes being as much as £34.

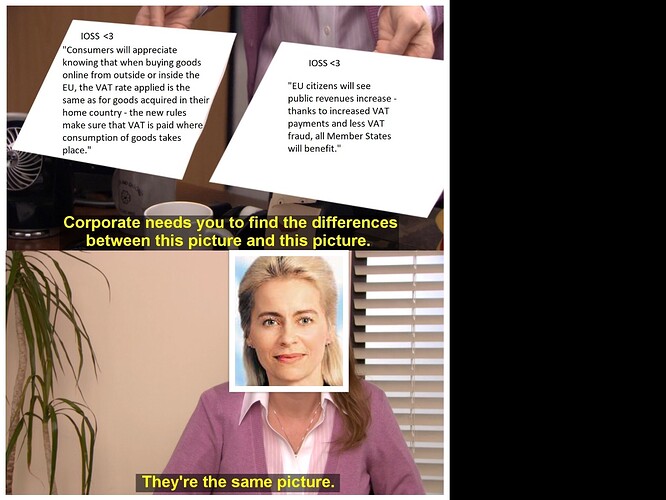

If you ever have chance to visit EU headquarters try being completely silent for a moment, you can actually hear these words echoing around the corridors.