In general, insuring personal items has a premium of 1% of the value per year. So if you have a $10,000 item, the premium would cost about $100 per year to insure. This probably does not carry over to collectibles, but just to give you a baseline.

My unsolicited advice - insurance is a scam that keeps people poor. The insurance companies still make a massive profit after paying for their glass offices, employees, and tons of advertising. This means the average payout from claims is significantly less than the average premium they bring in. So self insurance goes a long ways.

1 Like

I agree insurance is a scam, and can be extremely difficult to get a payout even when you’re in the right. However, if you’re talking significant sums of money you don’t really have a choice but to get it. The downside risk of things like death, or long term health issues can wipe a fortune of wealth extremely quickly. Almost all deca millionaires and billionaires are heavily insured.

With that said, I’m starting to explore insurance for my collection as well. I know some folks in the insurance/real estate/art/finance world, so I’m going to do some digging and see what I can find. Will report back to the efour gang when I have something.

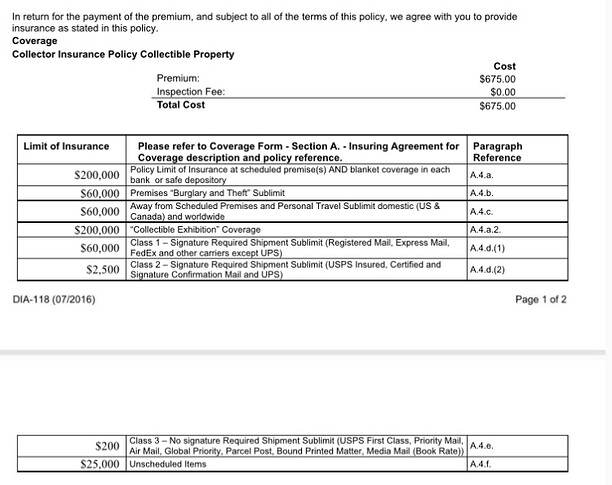

For transparency’s sake, after fees I pay $755 / annually for $200,000 in coverage which is split between two premises (cards in two different locations). $130,000 of that is for a handful of scheduled items worth above $25,000 each and individually recognized in my policy, and $70,000 is for non - scheduled. I do use security measures which may have reduced the cost of my policy.

There are cards I have opted not to separately insure such as some of the cards stored at PWCC Vault and a vault in Manhattan’s Diamond District.

I don’t really know the value of my full collection and I don’t want to, it stresses me out. Don’t rob me please.

A few years ago I tried to get a meeting with Christie’s climate controlled art storage and insurance service since they had humidity control and are located in NYC where I lived at the time, but they didn’t take me seriously once they realized what I wanted to store (even though they were initially happy to plan a meeting due to the valuation). smh snobs! Maybe would have different reaction today lol.

10 Likes

For big things like a house, I completely agree insurance is good to have. I think the biggest fish out there are self insured. My employer doesn’t have insurance and has dozens of locations across the world

@qwachansey Appreciate the transparency, this is super helpful! Is this your coverage with Collectibles Insurance Services or another carrier? I also live in NYC (13 years), and your experience with Christie’s is exactly what I would expect. NYC is a very odd place.

@eeveeteam I’m sure that exists, however keep in mind you cannot leverage your assets without insurance. A bank would not give a $70 million loan for a $100 million residential tower unless it had property and liability coverage. Likewise, most real estate owners and developers do not have a $100 million asset with no debt, although I’ve seen it once before. It’s an inefficient use of cash, and most want some sort of leverage even if it’s a “conservative” 50-65% loan to value.

Thanks for sharing. Might have to look into more and see how it works out for me!

2 Likes